Salary Benchmarking Best Practices

Survey Results: 2024

CompTool developed and administered this survey by soliciting feedback from HR and Compensation professionals during the months of April, May and June 2024. More than 530 Organizations participated in the survey and 346 completed the survey in its entirety. This report was designed to provide the Compensation Analyst and Compensation Leaders a dataset that they can better understand how other Companies are benchmarking their roles and the tools they are using to manage their compensation benchmarking.

How Do you Benchmark Your Jobs

We asked more than 500 compensation analysts what their approach is for creating market composites. This report explores the use of blending market data, applying premiums/discounts, and who is responsible for the market matching.

How Are Matches Reviewed

Compensation doesn’t stand still and the market is always moving. Companies that don’t review their jobs on a regular basis risk losing talent. This survey explores the approach and the frequency with how jobs are evalauted by compensation teams.

What Salary Surveys Are Being Used

There is so much data about salaries and wages now, but there are a handful of clear leaders in the space. We collected the most popular salary surveys, as rated by 500 participants in our survey.

What Salary Benchmarking Tools Are Used

Picking the right salary benchmarking software can be challenging. Most companies require multi-year agreements to leverage discounts. This study explores the most popular and highest rated compensation softwares.

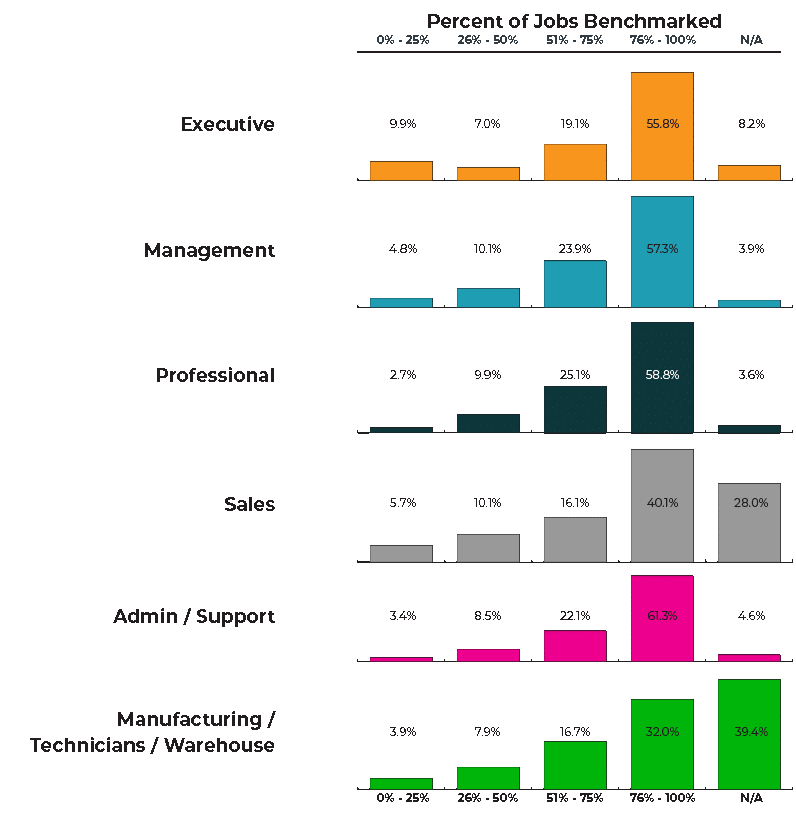

Most Companies Have Benchmarked At Least 75% Of Their Jobs

What percent of jobs in your organization are directly matched to survey benchmark jobs?

With the exception of the Executive roles, internal compensation teams are responsible for the benchmarking and evaluation of roles in approximately 90 percent of the organizations surveyed where the roles exist. Only 52 percent of organizations required their compensation teams to benchmark their Executive level roles. 38 percent of organizations have external consultants benchmark the Executive roles, and another 9 percent have a compensation committee carry out this responsibility.

Compensation Benchmarking Study: 2024

Send download link to:

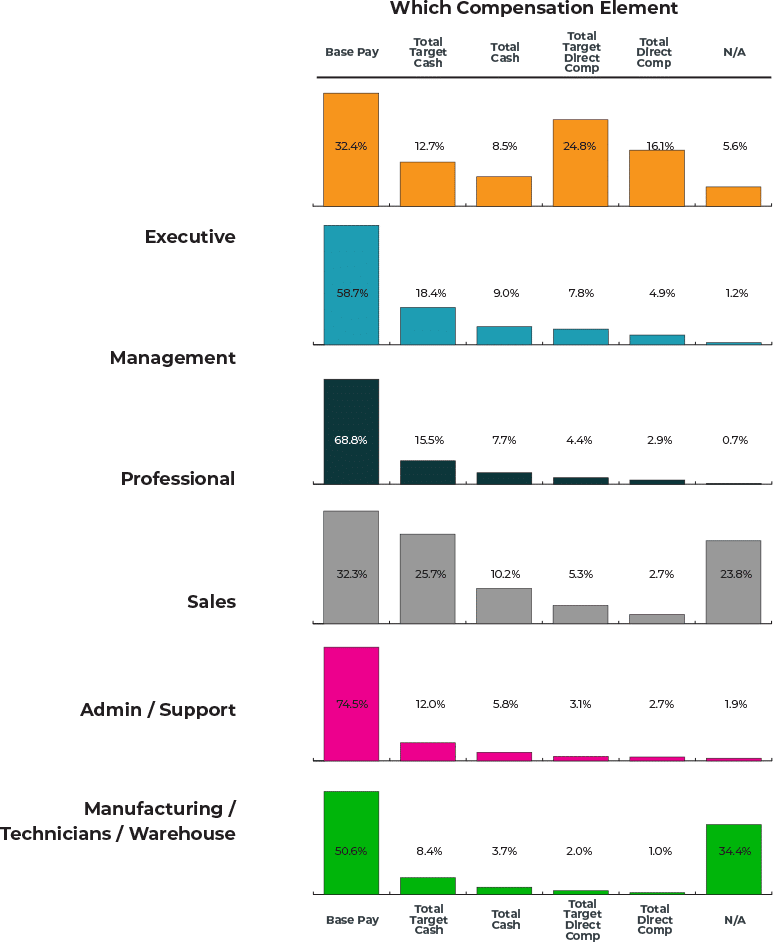

Base Pay is the most common Compensation benchmarking data

When you evaluate your jobs, which compensation element do you benchmark on?

Base pay remains the primary compensation element that companies use to benchmark their roles. Base pay is generally the most available and consistent data source available in salary surveys. Additionally, most pay bands exclude variable pay. Based on these points, that the majority of companies to use base pay, should be no surprise. One exception however, is Executive pay, where a significant portion of incumbents’ total compensation package is composed of variable pay elements. Companies are more likely to consider Total Target Direct, or Total Direct Compensation when benchmarking Executive level roles. Sales also sees a significant number of companies using Total Target Cash for benchmarking. Again, this can be attributed to the significant portion of variable pay in the Sales jobs’ total compensation package.

Compensation Benchmarking Study: 2024

Send download link to:

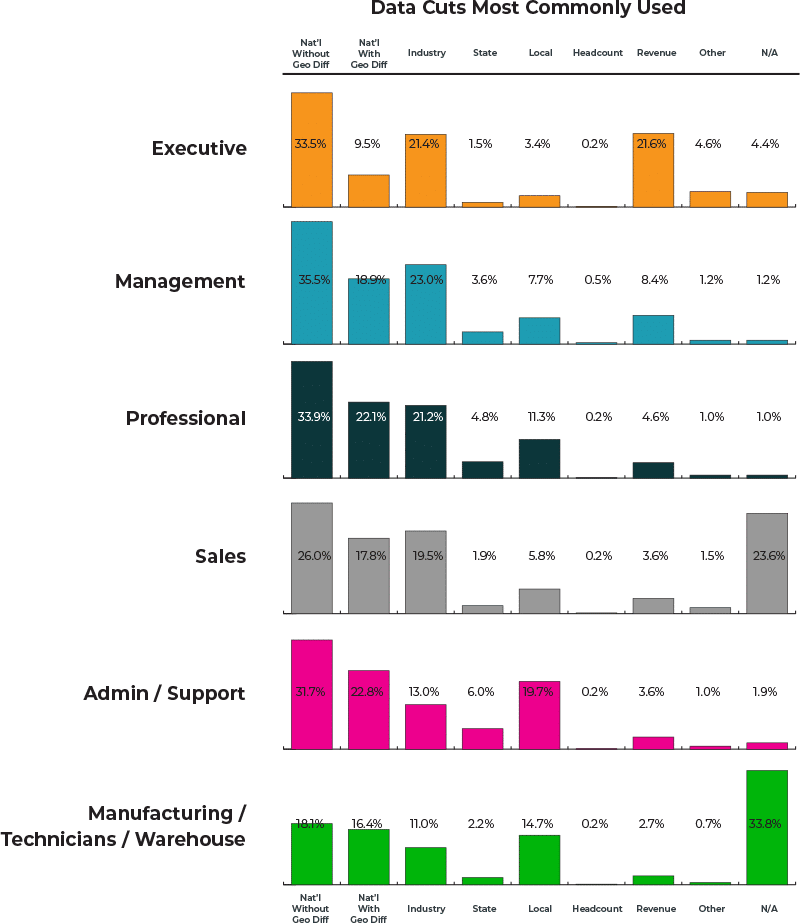

There is no Single dominant data cut companies use for Salary benchmarking

What salary survey data cuts do you primarily use to benchmark jobs relative to your competitive labor market?

For most professional and management level jobs, participants favor three data cuts when benchmarking: (1) national market data without a geo-diff (2) national market data with a geo-diff, and (3) industry. In addition to national data, revenue cuts are popular for Executive level roles. Local market data is popular for laborer or admin and support roles. Practically, companies may use these data cuts because they are reflective of where talent may come from.

Compensation Benchmarking Study: 2024

Send download link to:

Join us! It will only take a minute

How are you matching survey data to your benchmarks?

Compensation benchmarking is described as an art and a science. The art of compensation relies on considerable discretion in the approach that the science is applied. We asked our survey participants to provide some additional information about how they benchmark the data when they come across common situations.

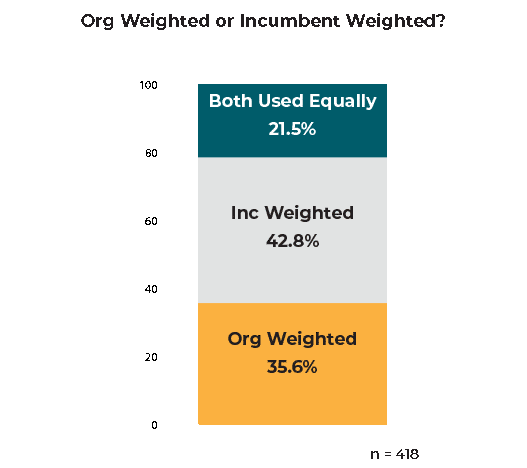

Org weighted or incumbent weighted?

Surprisingly, the distribution of companies that favor incumbent weighted data as compared to org-weighted data is similar. Org weighted data represents what companies are willing to pay for a job. Incumbent weighted data is what people in that job are earning. Org weighted may better reflect company policy, whereas incumbent weighted data may better reflect the actual labor market,

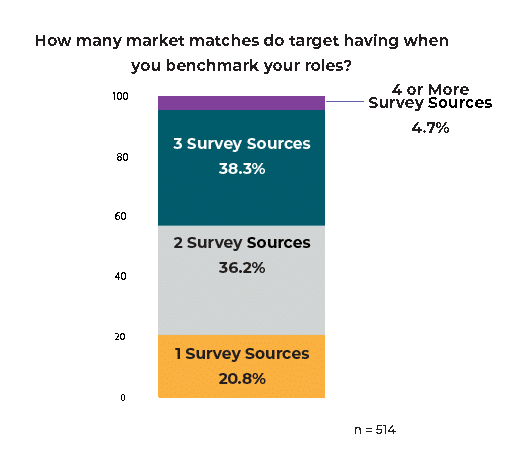

How many matches do you use when market matching?

Compensation best practices recommend that more than one source of data be used when evaluating jobs and we found that most companies reported they use several. Only one in five companies uses a single data source, but fewer than 5 percent of companies use 4 data sources or more, per job. Approximately 75 percent of companies use 2 or 3 sources to benchmark their roles.

Blending job levels or adding a biscounting/premium?

Market data sometimes is missing data for certain job levels within a family. Compensation Analysts have a few different options in handling this scenario, though none appear to be the standard. While a slightly greater percent of analysts apply a premium or discount, roughly the same number blend the two adjacent job levels together to determine the value.

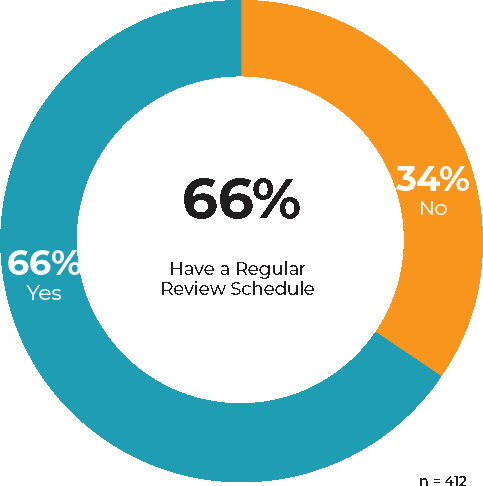

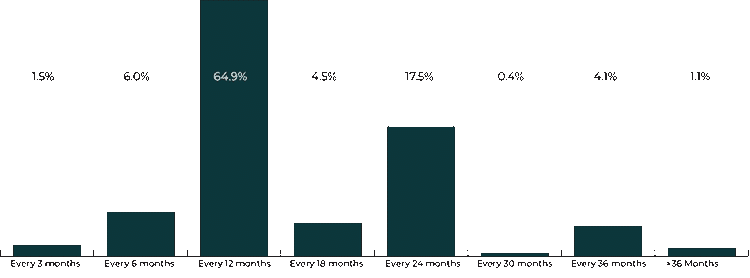

Reviewing Market Matches

What is the frequency that you review your matches to ensure the matches are still accurate?

Nearly 2/3rds of participants reported that they validate the accuracy of their market matches every 12 months. The next most common frequency is every 24 months, though biennial reviews account for only 17.6 percent of respondents. The annual review cadence is practical, as this is generally when salary surveys and pay structures are updated by most Organizations.

Compensation Benchmarking Study: 2024

Send download link to:

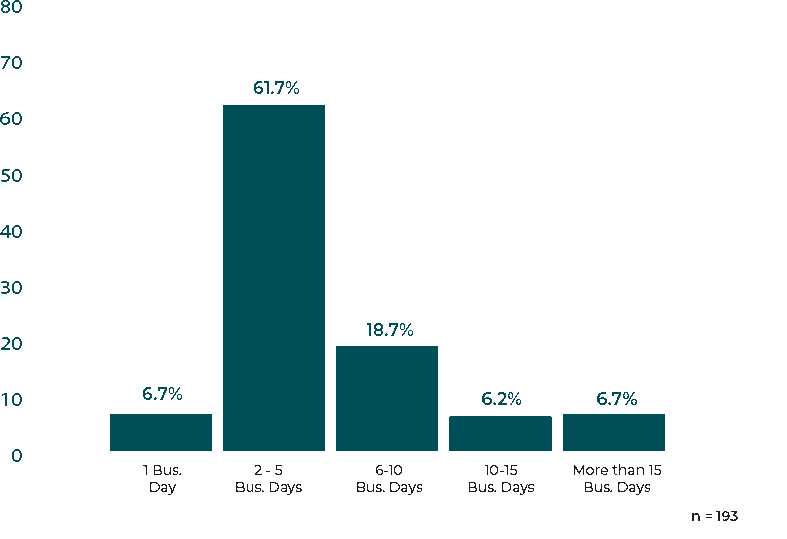

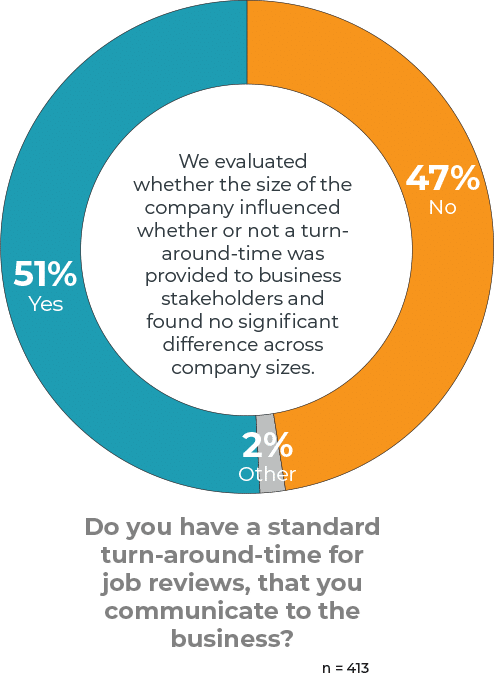

Service Level Agreements with Business Stakeholders

What is your standard turn-around-time for market reviews?

Our study found that there is a clear split as to whether or not Organizations have standard turn-around-times for market reviews. Of those that do offer a Service Level Agreement to internal stakeholders, the majority (67.4 percent) respond to market reviews within the same business week. 18.7 percent of organizations have a two-week response time.

Compensation Benchmarking Study: 2024

Send download link to:

We evaluated whether the size of the company influenced whether or not a turn-around-time was provided to business stakeholders and found no significant difference across company sizes.

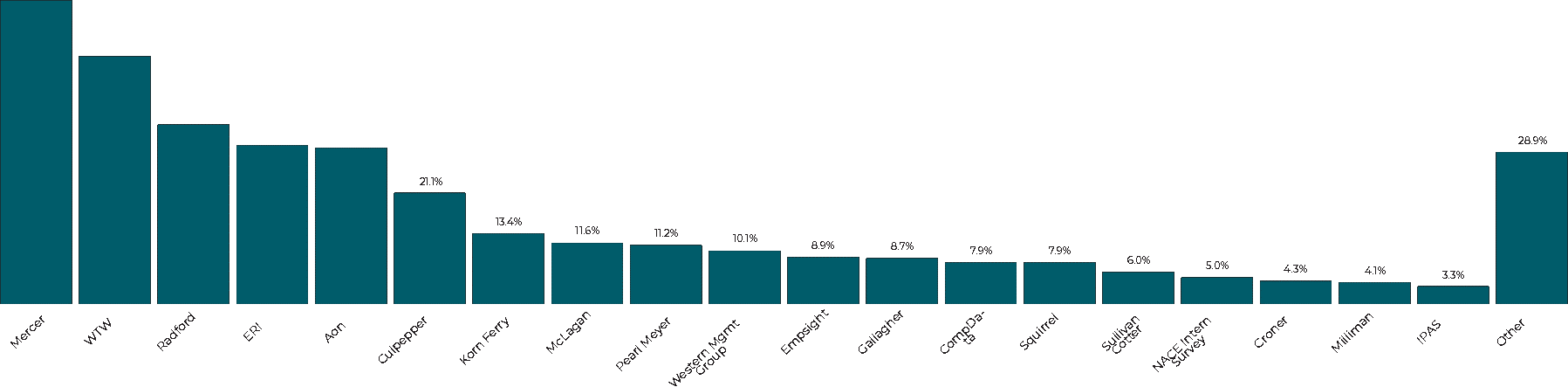

Which Salary Surveys do you currently subscribe to ?

We asked participants to indicate all of the salary surveys that they are currently subscribing to. The majority of participants (57.8 percent) reported subscribing to Mercer. WTW, Radford, ERI, Aon and Culpepper represent the following most popular surveys that survey participants currently subscribe to.

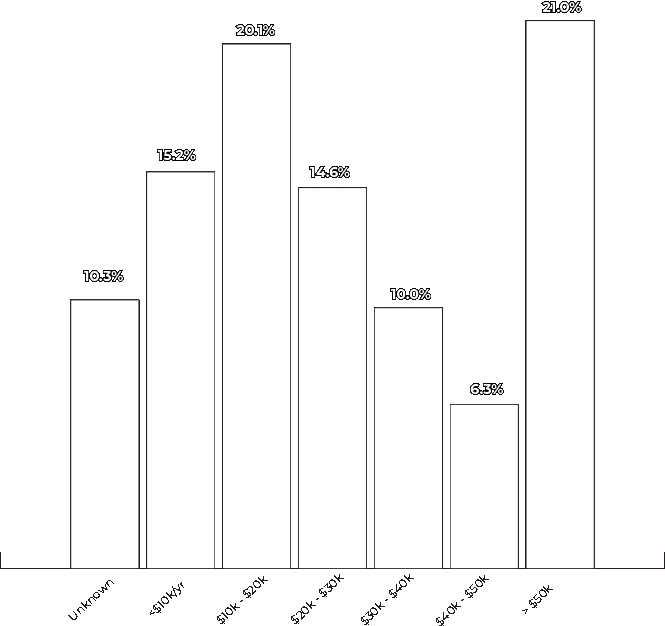

What is your approximate annual salary survey budget?

The number of salary surveys tends to increase based on the number of employees at the company. Participating companies with fewer than 500 employees had an average of 2.4 salary surveys.

Companies over 10,000 employees reported an average of 4.6 salary surveys.

Companies with a market pricing tool are also more likely to have a greater number of salary surveys.

On average, companies without a tool reported an average of 2.8 salary surveys. Companies with a market pricing tool reported an average of 3.6 salary surveys.

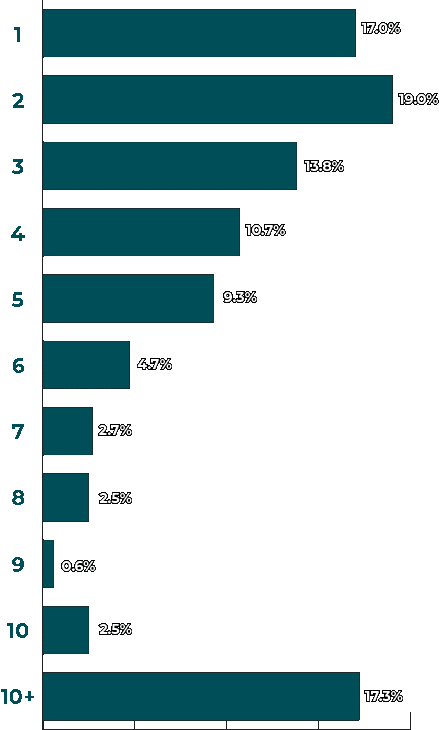

How many salary surveys do you subscribe to, Annually?

Download the Full Report

This report is available as a PDF for you to download and share with your compensation team:

Compensation Benchmarking Study: 2024

Send download link to:

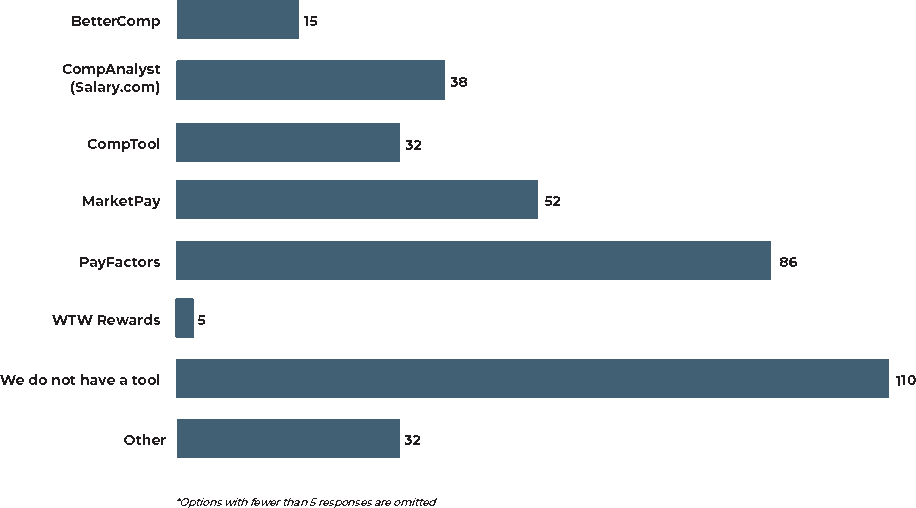

The Compensation Technology Landscape is Continuing to expand

Compensation Technology has grown over the past several years and compensation practitioners have more options than ever before.

The graph indicates the number of our survey participants and their respective market pricing software. The most common tool remains MS Excel. However tools like PayFactors and MarketPay are still heavily utilized,

while newer tools, such as CompTool, is rapidly growing and presents an exceptional option for compensation teams.

Importance of Various Features in Market Pricing Tools

Salary Benchmarking Tools have a variety of core and important features. The charts, below, provide an overview of what compensation analysts that participated in our study identified as some of the features that are important (or not important) to them when considering a market pricing tool.

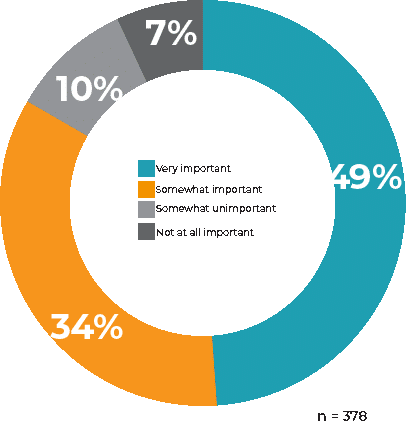

How important is having the ability to automate your salary survey participation?

Without a market pricing tool salary survey submissions are time consuming and tedious projects. Nearly half of companies say that this is a very important feature when considering the tool.

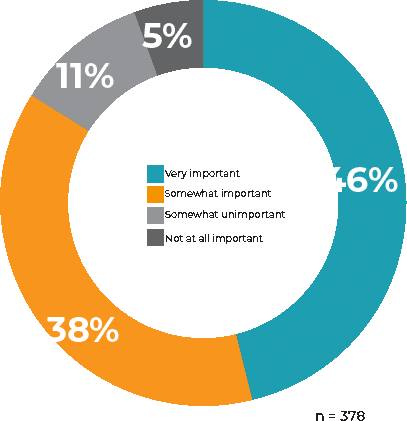

How important is having the ability to market price multiple jobs at once?

Software like CompTool allows Compensation Analysts to market price multiple jobs at once. This feature greatly streamlines the process for compensation teams finding matches across different job levels in different regions.

How important is is it for stakeholders to request a comp review?

Most participants rely on emails from the business to start a market review and do not consider the ability for a tool to allow stakeholders to submit and track market reviews of their jobs to be important in their

decision making process.

How important is it for you to be able to create your own custom reports ?

Reporting and analytics is considered one of the most important point of consideration for Customers selecting a market pricing tool. More than 4 out of 5 respondents to our survey stated it was important.

Find out why CompTool Was the Highest Rated Salary Benchmarking Software in The Survey

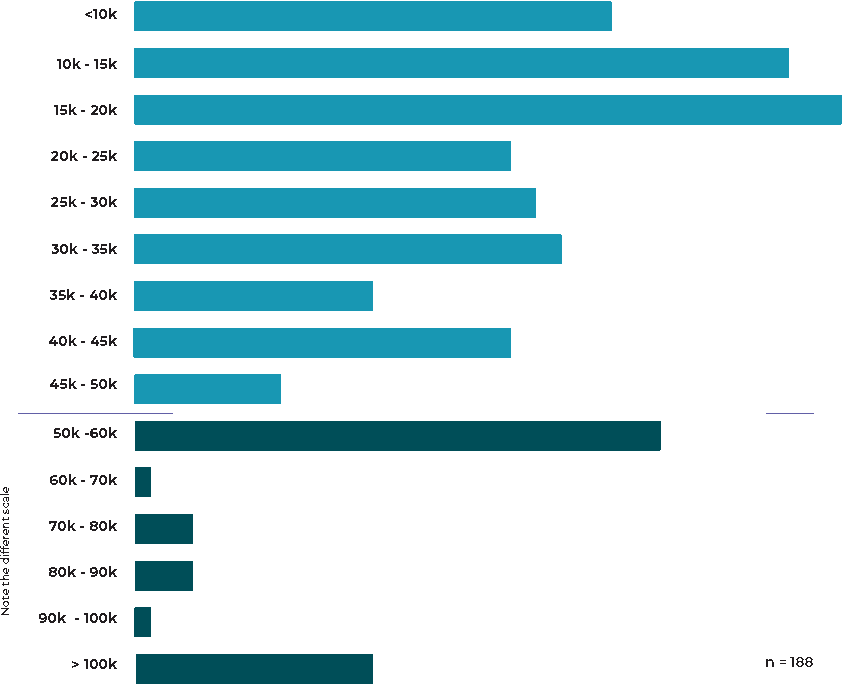

Prices vary dramatically

How much does Salary Benchmarking Software Cost?

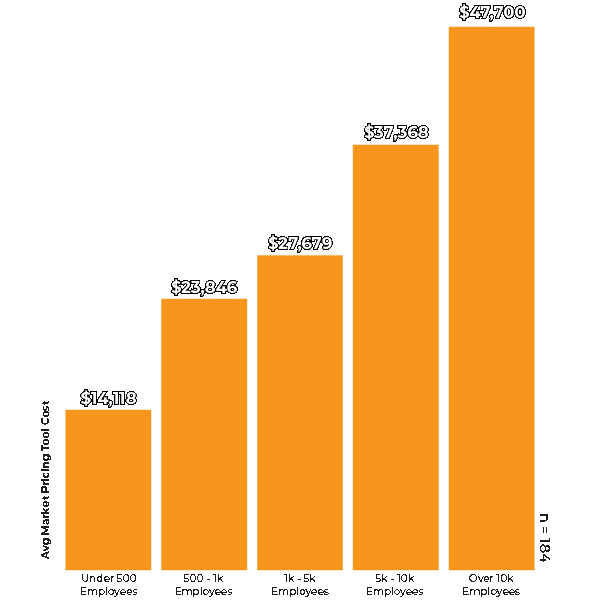

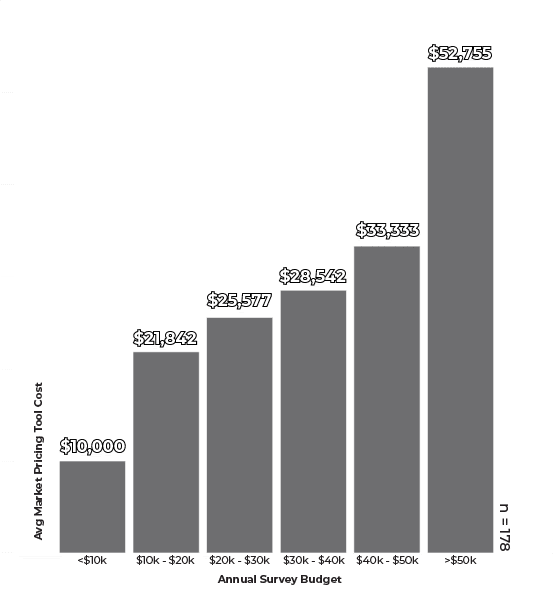

Prices for solutions vary significantly, with companies paying less than $10,000 per year, all the way to more than over $100,000 per year. The primary driver of the cost difference is based upon the software being used, the number of employees and the number of salary surveys companies subscribe to. In the pages that follow, we show a positive relationship of cost to company size and salary survey budget.

Costs for Salary Benchmarking Tools Increases with Surveys & Employees

The market pricing tool costs were calculated by taking the lower of the two numbers in the self-reported range that participants stated that they were paying for their market pricing tool, per year. These amounts are exclusive of fees such as add-ons, salary survey data, or implementation fees.

We find a direct correlation to the cost of market pricing tools as it relates to the number of employees. Companies that have a significant employee population likely have greater number of jobs and wage costs that should be validated.

We find a direct correlation to the cost of market pricing tools as it relates to the budget companies have set aside for salary surveys. Companies that have invested heavily in salary surveys are likely to be willing and able to invest in the slaary survey management tools.

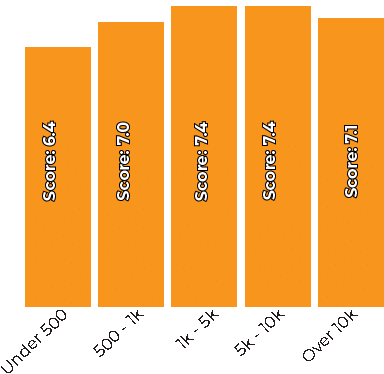

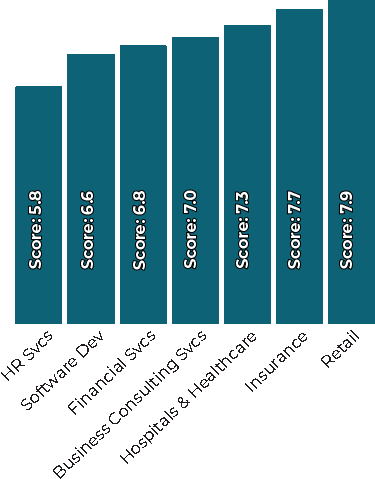

Overall Satisfaction with Salary Benchmarking Tools

Overall Satisfaction Based on the Company Size

Overall Satisfaction Based On The Company Industry

We asked participants to rate their overall level of satisfaction with their market pricing software. Most software scored in the mid 6 – 7 range and the average was a score of 7.1. CompTool was the one exception, with an average satisfaction score of 8.7 out of 10.0.

We find that company size does not greatly impact the overall satisfaction score. Companies with fewer than 500 employees report the lowest overall satisfaction.

We measured the most common industries that participated in this study. We find that HR Service providers are generally the least satisfied, whereas retail tends to report the greatest degree of satisfaction.