How to Manage Red Circle Employees

When an employee’s salary exceeds the maximum of their designated pay range, a situation known as “red-circling” arises. This scenario can create significant challenges for HR and compensation professionals, particularly when balancing employee engagement with budgetary control and fairness. The strategies to manage these situations can vary widely, each with its own implications for both the organization and the individual employee.

What is Red-Circling?

A red-circle employee is one whose salary has surpassed the maximum value of the pay range assigned to their role. This situation is typically due to reasons such as long tenure, high performance, a lack of career progression opportunities, or simply an outdated or evolving pay range. Unlike typical compensation situations, red-circling requires unique management to address the fact that these employees are being compensated at levels higher than the market standard for their position.

Why Does Red-Circling Happen?

Red-circling can happen for various reasons:

- Seniority and High Tenure: Employees with long service may have received numerous annual increases, pushing their pay above the set range.

- Exceptional Performance: High performers may receive merit increases that eventually lead them past the salary range maximum.

- Retention Concerns: Highly skilled employees with unique capabilities may be compensated at higher levels to prevent them from leaving, especially in tight labor markets.

- Market Adjustments: When salary ranges aren’t adjusted frequently enough to reflect market conditions, some employees might exceed the established maximum.

- Demotion or Other Role Changes: As Justin Hampton suggested, red-circling can also occur when an employee takes a demotion but their pay is not adjusted accordingly, resulting in them being overpaid for the work they are currently performing.

Approaches for Managing Red-Circled Employees

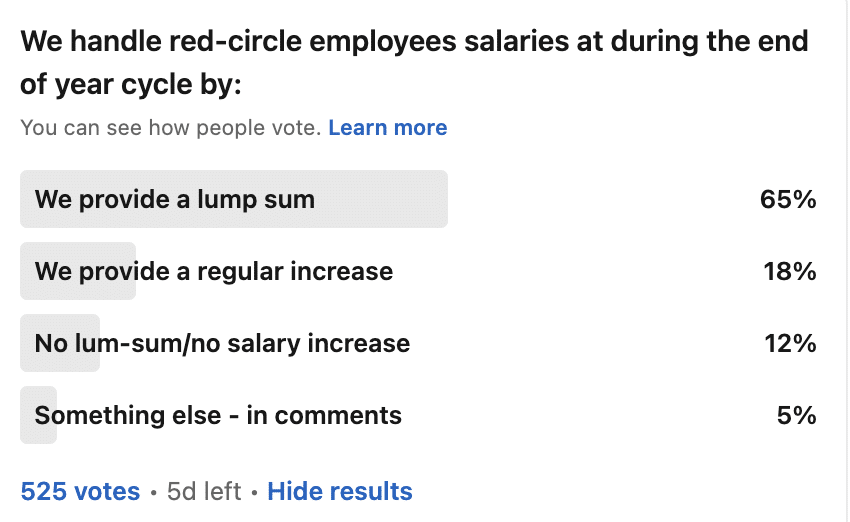

Once employees exceed the maximum of their pay range, organizations have several options for managing their compensation. Each approach has its own pros and cons, and the choice often depends on the company’s compensation philosophy, financial constraints, and culture. We conducted a short poll of compensation professionals on LinkedIn. More than 500 compensation professionals responded and the majority of professionals provide a lump-sum increase to the employees that are red-circled.

1. Lump Sum Increases for Red Cirlce Employees

Many organizations opt to provide lump-sum payments to employees whose salaries are above the maximum range instead of adding to their base salary. This allows companies to recognize an employee’s contributions without permanently increasing salary-related costs since the lump sum is a one time payment, and does not compound over years. However, the timing of the salary structure adjustment should also be considered so that red-circled employees truly are red-circles after the adjustments.

Pros:

- Cost Control: Lump sums prevent compounding year-over-year salary increases, which can help maintain budget stability.

- Employee Recognition: Employees still receive an acknowledgement of their performance, which helps maintain morale.

Cons:

- Perceived Inequity: As noted by Paul Reiman, lump-sum payments can create perceptions of unfairness among employees within the salary range, particularly if they receive smaller increases distributed throughout the year while those above the maximum receive a lump sum upfront.

- Limited Impact on Retention: Unlike base increases, lump sums do not provide a long-term retention incentive, which may be a disadvantage when trying to retain high performers.

This approach is the most common with 2/3rds of Organizations stating that this is their preferred approach to recognizing red-circle employees. Some organizations consider the employees’ performance before providing a lump-sum increase.

2. No Increase at All

Another approach is to simply withhold any salary increase once an employee has reached the maximum of their range. This strategy aligns strictly with maintaining internal equity and controlling costs. While this approach is less common due to the potential for attrition and perceived as punitive.

Pros:

- Alignment with Compensation Philosophy: This approach ensures that employees are not paid above the market value for their role, which helps maintain fairness and budget discipline.

- Cost Savings: By not offering increases, organizations can avoid unnecessary spending, especially in cases where the employee’s compensation is already well above market rates.

Cons:

- Potential for Demotivation: As David Turetsky pointed out, withholding increases entirely can feel punitive to employees, especially those who have contributed significantly over the years. This can lead to decreased morale and increased turnover risk. Paul Reiman added that withholding increases can also be justified as a way to ensure that compensation aligns strictly with market values and to avoid compounding costs unnecessarily, especially when the employee is already well-compensated relative to market benchmarks.

Given that only 1 in 8 Organizations identified this as their approach, we can assume most Organizations view the cost to outweigh the negatige impact to employee morale and attrition.

3. Regular Increases or Adjustments

A third option is to continue providing regular increases, either by adjusting the pay range itself or by moving the employee to a new role with a higher salary band. This approach is generally used when the organization feels the employee’s skills and contributions warrant continued investment.

Pros:

- Employee Retention: Continuing to offer increases can help retain high performers who might otherwise seek opportunities elsewhere.

- Career Development: By moving employees into roles with higher salary bands, companies can provide growth opportunities that align with the employee’s capabilities and contributions.

Cons:

- Cost Impact: This approach can be costly, particularly if many employees exceed their pay ranges. Paul Reiman highlighted that compounding salary increases for those over the maximum can have significant financial implications for the organization.

- Inconsistency: Offering ongoing increases to some red-circled employees can create inconsistencies in how compensation policies are applied across the organization.

- Pay Equity: Continuing to pay employees considerably over the maximum of the salary range can create pay equity challenges.

Nearly one in five Organizations continue to provide regular increases to their employees, even when they are over the max of the range. This approach, while it may continue to recognize employee performance, it can drive pay inequities and create significant costs for the business, while creating golden handcuffs for some employees.

Blending the Options

Additionally, some organizations mentioned that they consider the employees on a case-by-case basis to determine the approach. Several practitioners stated that the employee’s performance would be a key decision point in determining how to address their pay. For example, many organizations only provide lump-sum payments to red-circled employees that are also high performers. Other organizations provide a blend of a pay increase and a lump-sum payment.

Creating Policies to Manage Red-Circling

Developing clear policies around red-circling is crucial for ensuring consistency, transparency, and alignment with the organization’s overall compensation philosophy. When crafting these policies, HR professionals should consider the following:

- Define Clear Criteria: Establish clear criteria for when an employee’s pay can exceed the maximum range and how it will be managed. This includes specifying conditions under which lump sums, continued increases, or no increases will be applied.

- Transparent Communication: Clearly communicate the rationale for red-circling practices to affected employees. Transparency helps prevent misunderstandings and ensures employees understand the reasons behind their compensation outcomes.

- Balance Cost and Fairness: Policies should strike a balance between controlling costs and ensuring that employees feel valued. As Justin Hampton noted, managing pay for red-circled employees isn’t a simple process; it requires considering the human element while serving the business’s needs.

- Regular Review of Salary Ranges: Regularly review and adjust salary ranges to ensure they reflect market conditions. This can help minimize the frequency of red-circling and ensure that compensation remains competitive.

Conclusion

Managing employees who are paid above the maximum of their pay range is a complex issue that requires careful consideration of both organizational and employee needs. Whether opting for lump-sum payments, withholding increases, or continuing regular adjustments, HR professionals must weigh the implications for internal equity, budget constraints, and employee morale. By developing thoughtful policies and communicating clearly, organizations can navigate the challenges of red-circling while maintaining a fair and motivating work environment.

One response

Very helpful and the article is supported with the survey result which gives clarity on what comp and Ben professionals in market do.

This also helps benchmark practices