Understanding the Employee Burden Rate: A Comprehensive Guide for HR Professionals

What is a Burden Rate?

The burden rate, also referred to as the “employee burden rate”, is a key financial metric in HR and payroll accounting. It encompasses the total indirect costs of employing an individual beyond their base salary, including taxes, benefits, insurance, retirement contributions, paid time off, and any other expenses related to employment. By taking these additional costs into account, the burden rate offers a more accurate understanding of the true cost of an employee to an organization.

How Do You Calculate the Burden Rate?

The burden rate can be calculated using a straightforward formula:

Burden Rate = Indirect Costs / Direct Labor Costs

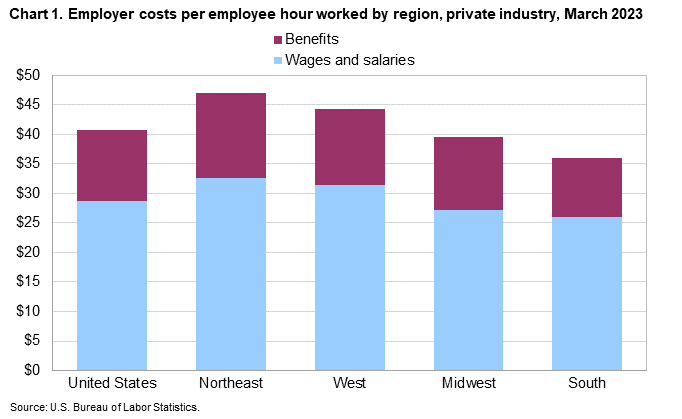

Direct labor costs refer to the gross wages paid to the employee, while indirect costs represent all the additional costs related to employment, such as payroll taxes, health insurance, life insurance, retirement plans, and so on. The US Bureau of Labor Statistics has calculated the burden rates, by region, across the US.

To calculate the burden rate, the indirect costs were used to calculate the burden rate included: total benefits, paid leave (including vacation, holiday, sick and personal leave), insurance costs (including health, and short- and long-term disability), Social Security, Medicare, unemployment insurance, and workers’ compensation.

When Does the Burden Rate Matter?

If you are calculating budgets and pricing, then calculating based on salary or wages alone leaves out a large piece of the puzzle. Understanding the burden rate is crucial for businesses in budgeting, pricing, project planning, and overall financial management. It’s particularly important when:

- Setting competitive, yet sustainable salary and benefits packages. Although many finance departments calculate burden rates on their end, it is important for the compensation team to have an understanding of the total costs of employees.

- Determining the pricing for services, especially in industries where labor forms a significant portion of cost.

- Analyzing the profitability of projects or contracts.

- Assessing the overall financial health of the business.

When Does a Burden Rate Not Matter?

Depending on the scenario or the analysis that is being done, burden rates may be slightly less important. Although you should always connect with your Finance Team to understand when the burden rate is used, generally speaking, it might be less relevant in scenarios where:

- Businesses use contractors or temporary staff, thereby significantly reducing or eliminating additional costs such as benefits or taxes.

- The focus is on short-term tasks or projects where direct costs are more immediate concerns.

- You are market pricing jobs and looking at market rates for Base Salary or Base and Bonus

FAQs About Employee Burden Rate

1. What is Burden Rate?

The burden rate represents the total indirect costs associated with employing a person, above and beyond their base salary.

2. How to Calculate Burden Rate?

Burden rate can be calculated using the formula: Burden Rate = Indirect Costs / Direct Labor Costs

3. What Indirect costs should be included when calculating a Burden Rate?

Total benefits, paid leave (including vacation, holiday, sick and personal leave), insurance costs (including health, and short- and long-term disability), Social Security, Medicare, unemployment insurance, and workers’ compensation.

4. What is the Average Burden Rate for Employees?

The average burden rate can vary greatly depending on industry, region, and the benefits offered by an employer. As a general rule of thumb, it often ranges from 1.25 to 1.4 times the employee’s salary.

Sources:

- Investopedia – How to Calculate and Analyze a Company’s Operating Costs

- SHRM – Managing Employee Compensation

Suggested Reading:

- “Compensation” by Milkovich, Newman, and Gerhart

- “Strategic Compensation: A Human Resource Management Approach” by Joseph J. Martocchio

- “Rewarding Performance: Guiding Principles; Custom Strategies” by Robert J. Greene

2 Responses

Great article, Justin! Simple explanation and valuable information for all professionals working in HR. In addition, this non-jargon explanation is helpful for managers and employees to understand that all the extras provided by the company are ‘hard’ dollars and should be considered when looking at the compensation package offered.

This is awesome! How do you address when employees choose not to take your benefits? Lori