As compensation professionals, there are times when we need to apply premiums or discounts to the salary benchmark data we are working with. A premium or discount could be because our job has greater or fewer responsibilities than the market match. We may apply a geographic differential to a national data cut to account for a high-cost-of-labor market or a low-cost-of-labor market. Discounting or applying premiums to the salary benchmark data is a basic function of comp, but as with many things in compensation, there are different ways to skin this cat.

A Real World Scenario

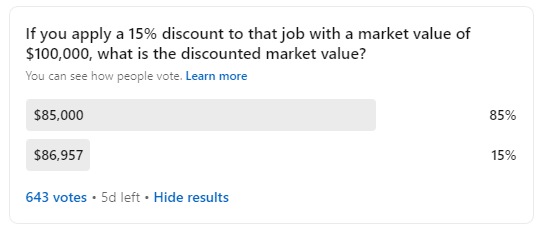

We’ve found a job in our salary surveys with a market value of $100,000, and want to apply a 15% discount to that salary benchmark because our job has fewer responsibilities.

So, what is the approach we take to discount our benchmark job by 15%? Would we multiply the salary benchmark data by 0.85, or would we divide the data by 1.15? Each approach could be considered a 15% discount, but they have different results:

- $100,000 ÷ 1.15 = $86,956.52 or,

- $100,000 x 0.85 = $85,000.00

As we can see, there is a difference of $1,956.52 between the two calculations. Why does this difference occur? Well, the answer is: because math.

Grossing Up vs. Marking Down the Salary Benchmark Data

When we divide $100,000 by 1.15, we get $86,956.52, which is the number that multiplying by 115% would result in a $100,000 salary. This would be useful in scenarios where we want to set the rates of pay where an employee receiving a 15% increase would get them to the market rate, but it would not necessarily represent a discount of the market data by 15%.

On the other hand, when we multiply $100,000 by 0.85, we are essentially marking down the number by 15%. This could be useful in scenarios when we believe our job has a value that is 15% less than the market data. However, we could not apply a 15% premium to this number and get to $100,000.

Which Should be Used to Discount Your Salary Data?

So which one should you use to discount your salary benchmark data? Kaushik Basu, Associate Director – Total Rewards at Cognizant explains, “Since the anchor here is the market value, I would use $85,000. I think it’s important to take a step back and identify if the job value is 15% lesser than the market match or the market match is 15% higher than the job value.” And Kaushik isn’t alone.

We surveyed more than 600 compensation practitioners and multiplying the market rate by 0.85 was favored by (coincidentally) 85% of compensation practitioners.

But this seemingly innocuous question brings up an interesting point about the art and science of compensation. Dione Lockyer, Compensation Advisor at Avenue Living Asset Management explains, “…there is room for more complex discussions around compensation calculations against market in general. Alignment can differ from a financial calculation which is often a large challenge for those comp roles that feed into finance.

It’s really insightful to offer the perspective of which way you need to look at the formula and apply to each situation. They are different results, which we should be checking ourselves on and preparing for the discussions when we are told we are wrong.”

So, while both answers can be right in the right situation, it is important to be aware of the reasons why one may be used over the other, and be prepared to explain the rationale behind either.

No responses yet