How Salary History Should be Considered When Evaluating Employee Pay

The compensation consultant is responsible for helping the business understand if they are paying their employees competitively and fairly. As part of this role, being able to tell the complete story about an employee’s total rewards journey within the organization is important. There are many points that should be considered and this article provides a suggestion for how salary history fits into the equation.

The Limitations of Pay History

While pay history can be a valuable piece of an employee’s Total Rewards journey, there are limitations. This article does not imply that an employee’s opportunity for pay increases should be based on solely on their history, but rather that it is one part of the story to be told. This article should not be taken to imply that an employee should be penalized for their pay history, either.

In addition to salary history, other points should be considered:

- Performance

- Market data

- Internal Equity

- Compensation Philosophy, and

- Salary History

This article only discusses only salary history, and how it can be effectively used to tell the entire story.

How to Use Salary History to Evaluate Pay Increases

Salary history is an important data point to consider because it helps us to better understand the employee’s career and pay story. Although many state or city laws prohibit candidates from being asked to provide their current salary during the interview process, salary history can be a valuable data point to be considered for current employees.

In most Organizations, the Compensation team may make recommendations for an employee’s pay but is not the final authority. For the Compensation team to create the strongest and most comprehensive recommendations, including salary history in the employee analysis can significantly help the manager’s decision about providing further pay adjustments.

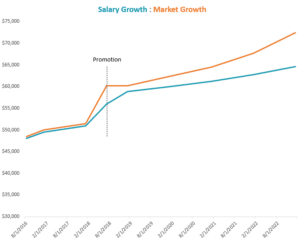

Consider the image below and the story it tells.

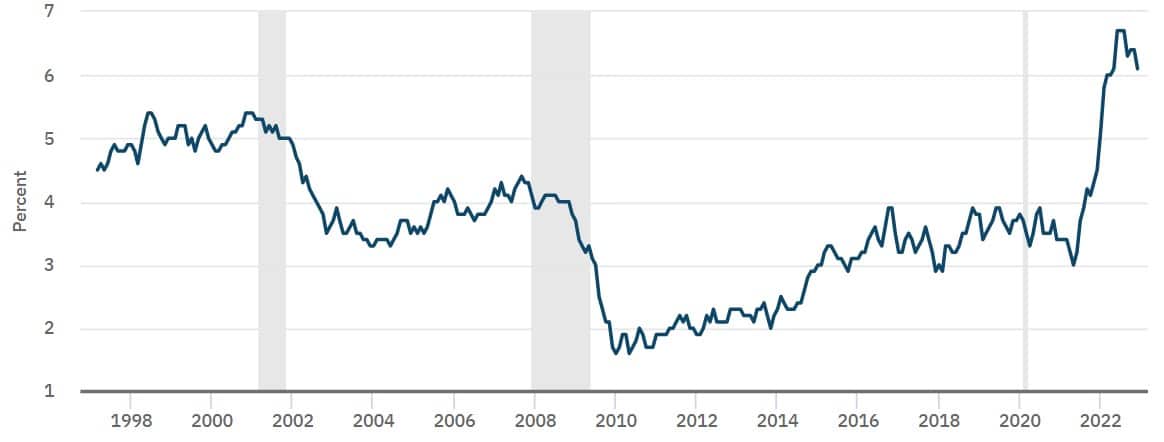

By comparing the employee’s pay history to the relative market growth, we can clearly show that the employee’s pay has not kept up with the market growth, since their promotion in 2018. Additionally, we can see that the gap increased more dramatically in 2022 when inflation rates were at 40-year highs.

This chart depicting salary growth in comparison to the market growth helps us to tell part of the story: This employee’s historical pay increases have not kept up with the market. Including this part of the story allows the Compensation consultant to have a thoughtful conversation with management about the cause of the problem (if there is one) and more easily decide whether or not a pay increase may be warranted.

Conclusion

If the Compensation Consultant couples this chart with the other bullets mentioned at the start of this article, we have a much more comprehensive story about the employee’s total rewards journey, than without it. Providing the full story allows us to make thoughtful recommendations to the Business, and reinforces the Compensation team’s partnership with the business.

One response

Great article. Could you please say how all these varables could be displayed in correlation ?