Pay for Performance: A Blend of Compensation

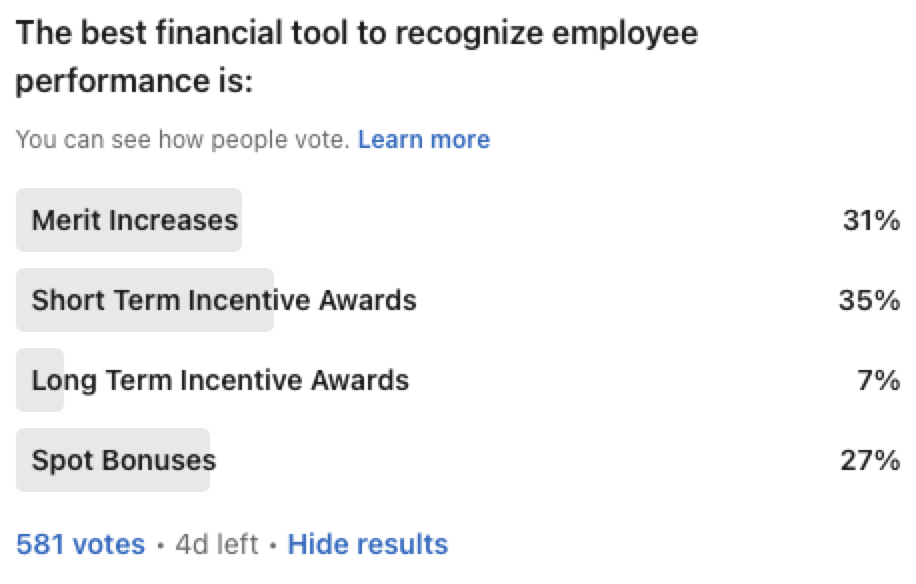

The concept of “Pay for Performance” stands out as the cornerstone of modern reward strategies. This approach ties financial rewards directly to the individual’s contributions, aligning personal achievements with organizational success. The recent poll of over 581 compensation professionals has provided a deeper insight into how various types of compensation can be woven together to administer holistic and effective “Pay for Performance” programs.

If Compensation Analysts are the maestros of pay, then their symphony is “Pay for Performance”. Just as Beethoven used various instruments to create his masterpieces, compensation teams would need to carefully orchestrate the various instruments at their disposal to create the perfect symphonies.

Short-Term Incentives: Quick Pay for Performance

Short-Term Incentive (STI) Awards are pivotal in driving immediate results and aligning employee behaviors to an organization’s quarterly or annual goals. STIs are the percussive beats that energize employees to meet and exceed short-term objectives. By including these incentives in the employee’s total compensation package, companies can quickly and directly push for performance and capitalize on the direct relationship between immediate efforts and rewards. The effectiveness of STI programs is likely why more than 90% of private companies use some form of short-term incentive program, according to a recent World at Work study.

However, the compensation team must ensure that the short-term targets are created in a challenging yet achievable manner. Short-term Incentive targets that are too easy can create a sense of entitlement and expectation, leading to ineffective use of cash. Short-term incentive targets that are too challenging may discourage performance, as the goals may feel unobtainable. Balancing STIs within “Pay for Performance” programs requires a strategic approach to ensure they remain effective without compromising future growth.

Questions to Ask When Developing a Short-Term Incentive Plan

- Alignment with Business Objectives: Ensure the incentive program aligns with the short-term objectives of the company and that the Plan’s rewards will drive the right behaviors.

- Budget Constraints: Determine the budget for the incentive program and ensure an ROI. This includes considering the program’s overall cost and ensuring it is financially sustainable for the company.

- Plan Participants: Identify the groups or types of employees eligible for the incentive program. Consider the roles that are most crucial to achieving the short-term objectives. Special consideration should be given to different employee groups – where exempt vs. non-exempt employees may have different payment calculations to remain compliant with local and federal laws.

- Performance Metrics: Define clear and measurable performance metrics that employees must meet to qualify for the incentives. These metrics should be challenging yet achievable and directly linked to business outcomes. Additionally, Plans should aim to have between 3 and 5 metrics. Anything beyond 5 creates unnecessary complexity and begins to dilute the primary objectives.

- How small is too small: $100 or even $1000 may not be enough to effectively drive the desired behaviors. Incentive programs need to consider the dollar amount needed to drive the right behaviors from plan participants. If they aren’t driving the right behavior, you may be throwing money away.

- Fairness and Equity: Ensure employees perceive the program as fair and equitable.

- Legal and Regulatory Compliance: Ensure the incentive program complies with all relevant labor laws and regulations. This is crucial to avoid any legal issues. It is highly recommended that legal teams are provided a copy of incentive Plan documents to ensure compliance.

- Keep it Simple: Balancing accuracy and simplicity is important. Highly complex programs, in theory, maybe more accurate, but at the expense of employee comprehension. If employees do not understand how the Plan works or find it too complicated, the Plan is likely to fail.

- Communication Strategy: Develop a clear communication plan to inform employees about the incentive program. Transparency about how the program works and how employees can qualify is essential. Additionally, the frequency of communication throughout the Plan Period is also critical.

- Program Administration: Consider the logistical aspects of administering the program, such as tracking performance, calculating payouts, and addressing disputes or clarifications.

- Cultural Fit: Ensure the program fits the company’s culture and values. It should motivate employees in a way that is consistent with the company’s ethos.

- Evaluation and Adjustment: Plan for ongoing evaluation of the program’s effectiveness. Be prepared to make adjustments based on feedback and changing business needs. A clearly outlined Exceptions policy can be highly beneficial for the ongoing maintenance and evaluation of the Plan.

Merit Increases and its Role in Pay for Performance

Merit Increases resonate as the continuous melody in “Pay for Performance” compositions, rewarding sustained individual performance and dedication. They add a fixed expense to the business but they are also key tools used to invest in the employee’s future with the organization. Merit increases are also a fundamental component in ensuring employees’ pay remains aligned with the labor market. When incorporated thoughtfully, merit increases maintain internal equity and demonstrate a commitment to fair pay for ongoing contributions. Yet, as they become a permanent fixture in the salary structure, they necessitate careful consideration to avoid financial dissonance, such as salary compression or inflation.

When developing a merit pay program for an employee’s annual review, HR and compensation teams need to consider a variety of factors to ensure the program is effective, fair, and aligns with the company’s goals.

Here are ten key considerations when developing a Merit Program:

- Alignment with Organizational Strategy: Ensure that the merit pay program supports the overall business strategy and objectives. It should reward behaviors and results that align with the company’s long-term goals.

- Performance Evaluation Criteria: Establish clear, objective, and measurable criteria for performance evaluation. These should be directly linked to the employee’s role and responsibilities, and they should be communicated clearly to all employees.

- Development of the Merit Matrix: Merit matrices are designed to ensure equitable distribution of a finite budget pool across employees. Most merit matrices consider employee performance and range penetration but may not award top performers enough – usually because this robs the budget from a fixed pool, leaving little for average performers. A more detailed discussion on the hazards of merit matrices can be found in our article on merit pay.

- How Much More Should High Performers Earn: High performers move the needle, and an extra 0.25% may not send the right message.

- Budget Availability: Determine the budget for the merit pay program. This involves allocating funds for the current period and planning for future financial implications. Compensation teams should partner with the Finance team to ensure that not only are budgetary constraints met, but that the Organization’s alignment to market is also considered.

- Market Competitiveness: Regularly benchmark the merit pay program against the market to ensure that the compensation remains competitive and can attract and retain talent.

- Internal Equity: Assess and maintain internal pay equity. Employees in similar roles with similar performance levels should receive comparable pay increases to ensure fairness.

- Legal Compliance: Ensure the program complies with all relevant employment and labor laws, including non-discrimination policies.

- Communication and Transparency: Develop a communication strategy to explain the merit pay program to employees clearly. Transparency about how decisions are made can increase trust and acceptance. We recommend various means of communication, including employee newsletters, brown-bag discussions, and equipping managers with the skills they need to have conversations about compensation with employees.

- Manager Training: The program should effectively differentiate between various levels of performance, rewarding higher performers with greater increases to incentivize productivity and excellence.

- Administrative Feasibility: Consider the administrative effort required to implement and manage the program. This includes the processes for evaluating performance, determining pay increases, and handling disputes.

- Feedback and Employee Development: Incorporate a system for providing constructive feedback to employees. Merit pay should be part of a broader approach to employee development and performance management.

- Software Used to Manage the Process: Merit processes can involve numerous stakeholders and can be prone to expensive errors in the process. Using tools like SimplyMerit or Visier can improve the process, the communication and reduce costly errors (potentially paying for themselves).

Spot Bonuses: Instant Pay for Performance

Spot Bonuses offer the dynamic crescendos of “Pay for Performance” programs, providing on-the-spot rewards for exceptional achievements. These bonuses are the discretionary fortissimos that, when applied equitably, can significantly enhance employee morale and motivation. The challenge lies in their execution; to prevent a cacophony of perceived unfairness, spot bonuses must be distributed in a transparent and consistent manner, ensuring that each instance of recognition is fair and contributes positively to the organizational culture.

Considerations for Incorporating Spot Bonus in the Pay for Performance Program

- Clear Objectives and Criteria: Define the specific objectives of the spot bonus program. Establish clear criteria for exceptional performance or behavior that warrants a spot bonus. This helps maintain consistency in how bonuses are awarded and ensures that employees understand what actions or achievements are rewarded. While spot bonus programs can be effective tools in the pay-for-performance program, they also usually have the fewest guard rails.

- Equity and Fairness: Spot bonus programs are usually discretionary and may not have the same objective performance metrics as other incentive programs. Compensation teams must ensure the distribution of spot bonuses is fair and unbiased. Setting objectives and criteria is the first step; ongoing audits that track and monitor the allocation of bonuses should also be incorporated to avoid favoritism or discrimination.

- Communication and Feedback: Communicate the existence and purpose of the spot bonus program to all employees effectively. Transparency about how decisions are made can enhance the perceived value of the program. Additionally, gather feedback from employees about the program’s impact on motivation and engagement, and be prepared to make adjustments based on this feedback.

Long-Term Incentives: Pay for Continued Performance

Long-Term Incentive (LTI) Awards are the sustained notes that bind an employee’s present efforts to the organization’s future success. LTIs are instrumental in fostering long-term commitment, aligning the interests of employees with the strategic direction of the company. While they are complex and require employees to invest in the future, they are a fundamental part of a “Pay for Performance” strategy that aims to sustain growth and stability over time.

- Strategic Alignment with Performance Goals: As with all incentive programs, the end result should be driving company objectives. Compensation teams should focus LTI programs on aligning the employee rewards with specific performance goals over a 3 to 5-year horizon.

- Choose the Right Participants: While it varies by industry, LTI programs are typically reserved for key or executive-level employees the company has a vested interest in long tenure.

- Robust and Measurable Performance Metrics: Establish rigorous and quantifiable performance metrics that are closely tied to the company’s key performance indicators (KPIs). These metrics should be easily understandable, transparent, and directly linked to the value creation for the company.

- Simplicity and Administrative Efficiency: Design the program as simply and administratively efficient as possible. Complexity can lead to misunderstanding and increased administrative burden. Streamline processes for granting, tracking, and vesting of LTIs to ensure they are manageable and cost-effective.

- Clear Communication and Alignment with Corporate Culture: Develop clear, concise, and effective communication strategies that align with the company culture. This ensures that the program is well understood and embraced by employees, enhancing its effectiveness in driving desired behaviors.

- Legal and Regulatory Compliance: Maintain strict compliance with legal and regulatory requirements, particularly in terms of disclosure and reporting, to avoid legal complications that could impact the company’s reputation and financial standing.

- Market Competitiveness and Attractiveness: Regularly benchmark the program against the market to ensure it remains competitive and attractive to current and potential employees, especially key talent crucial for the company’s success. Highly regarded salary surveys that are “out of the box” may be sufficient, though many companies will work with compensation consultants to develop custom salary surveys to track LTI programs.

- C-Suite and Board Involvement: Engage with the C-Suite and the Compensation Committee in the development and ongoing review of the program. Their buy-in is crucial for ensuring alignment with corporate objectives and for effective communication of the program’s value and success.

Crafting the “Pay for Performance” Symphony

Integrating these diverse elements into a cohesive “Pay for Performance” strategy requires meticulous orchestration. The balance of STIs, merit increases, spot bonuses, and LTIs must be carefully managed to ensure each element harmonizes with the others, supporting both immediate achievements and future goals. Transparency, fairness, and a clear understanding of the company’s objectives are the guiding principles for this strategy.

No responses yet